The Time has Come For Full Indemnity Cost Recovery In Successful Accident Benefit Disputes

Author(s): Darcy R. Merkur

April 3, 2023

Is anyone else offended by the notion that billion-dollar insurance companies have no obligation to contribute to the legal costs associated with their own customers successfully disputing matters against them?

By comparison, as explained below, the Ontario Superior Court of Justice recently confirmed that Long Term Disability (LTD) Insurers have an obligation to pay full indemnity costs in similar circumstances (i.e. LTD insurers must pay the claimant’s full legal costs so that the claimant isn’t burdened financially when successfully fighting with their insurer).

In Ontario, any person injured in any way by a car has access to no-fault accident benefits. The no-fault accident benefit insurer has a duty of good faith to its customers – essentially meaning that they must look out for the injured person’s best interests.

As a trauma lawyer helping accident victims, I often have to start formal disputes with my client’s accident benefit insurer. Many of these disputes involve complex and important issues warranting lengthy hearings that can take as long as two weeks.

For example, in the accident benefit context, a “catastrophic impairment” designation (CAT) is a crucial designation reserved for severely injured persons. The CAT designation increases an accident victim’s benefit entitlement by roughly $1 million.

If the accident benefit insurer challenges the claimant’s entitlement to a CAT designation, then the claimant must pursue any dispute through the Licence Appeal Tribunal (the LAT).

Historically, accident victims had the choice of having disputes determined by a Court or by the Financial Services Commission of Ontario (FSCO). Both the Court process and the FSCO process included cost recovery mechanisms that allowed successful claimants to recover a portion of their legal costs from their insurer, including their often-substantial disbursements.

Sadly (and somewhat shockingly), the current mandatory LAT dispute process does not include any meaningful cost recovery provisions. As a result, a successful claimant remains on the hook for the enormous disbursements spent by their counsel have experts to testify at a dispute.

For illustration purposes, claimant’s counsel will typically incur $25,000 to $50,000 (or more) on disbursements simply to pay experts for testifying at a LAT CAT dispute, over and above the substantial counsel fees. Even where the claimant succeeds in a dispute and a settlement is later achieved, these disbursements must be paid by the claimant, thus reducing their net recovery.

By way of comparison, in long-term disability disputes, the Court has recently expressed the sentiment that benefits should not be eroded by the cost of successfully disputing matters with the insurer.

My TR Law partners, Stephen Birman, Robert Ben and Lucy Jackson, recently obtained a spectacular Jury result in an LTD dispute. Their client was awarded one of Canada’s highest punitive damages awards against the Defendant, Blue Cross.

In the cost Endorsement by The Honourable Madam Justice Vella (in Baker v Blue Cross 2023, ONSC, 1891), Her Honour stated as follows at paragraph 18:

“Accordingly, I am persuaded that the rationale derived from the duty to defend cases justifying full indemnity costs should extend equally to long-term disability insurance cases, including this one. In these cases, the insured must pursue litigation against her insurer to obtain the contractual monthly benefits she purchased by way of a long-term disability insurance policy to provide for basic living requirements. It would not be fair or reasonable to erode her fixed monthly income replacement benefit by payment of unrecoverable legal fees in these circumstances.”

The Court goes on to exercise their discretion to award full indemnity costs. The Court states at paragraph 19:

“I am therefore exercising my discretion under s. 131 of the Courts of Justice Act to award full indemnity costs. I find that the wrongful denial of long-term disability benefits by an insurer, given the unique character of long-term disability insurance policies, constitutes special circumstances justifying this elevated award. By so doing, I am not commenting on the propriety of extending this rationale to other types of insurance contracts as those circumstances were not before me.”

In short, the Court recognized that where a claimant is forced to sue her own long term disability benefit insurer simply to receive benefits she was promised, she should not receive less because of the legal bills she faces.

In my view, the same logic applies to accident benefit disputes. If the accident benefits insurer has taken a position denying benefits that are later determined to be improper, then why should the claimant have to spend money out of their own pocket when they succeed with the dispute?

Without a cost recovery element in the LAT, claimants are discouraged from pursuing justice.

The unrecoverable financial costs associated with LAT disputes remain a major barrier to access to justice.

I find it unbelievable that the Ontario government has designed and made mandatory a dispute system that unfairly puts the rich insurers in a position to stomp the poor claimants. The time to change this rule is long, long, long overdue.

At least in circumstances where the accident victim has a lawsuit pending, the costs associated with disputes with accident benefit insurers can be claimed in the lawsuit. However, that option does not help claimants who are not pursuing a lawsuit and who are wrongly being denied benefits by their accident benefit insurer.

Accident benefit insurers must be required to contribute to a claimant’s legal costs and disbursements when the claimant successfully wins a dispute against them. The Ontario government must fix this systemic unfairness.

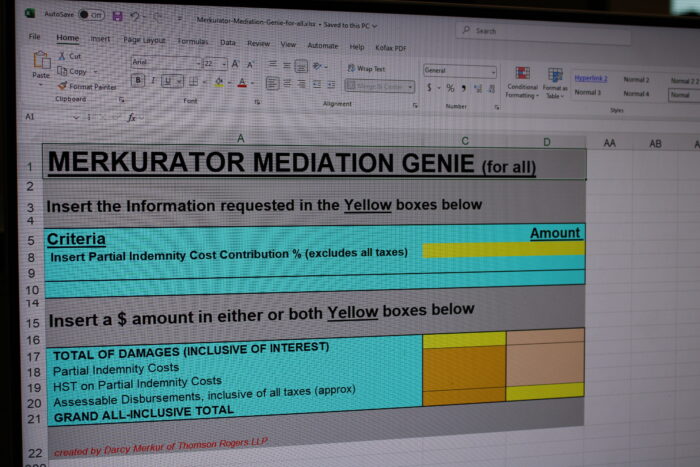

Darcy Merkur is a highly regarded Ontario trauma lawyer helping accident victims such as pedestrians, cyclists and motorists who have sustained catastrophic injuries.

Darcy is the first lawyer in Canada to be qualified as a Certified Brain Injury Specialist by the Brain Injury Association of America. In addition, Darcy has been recognized as a Certified Specialist in Civil Litigation by the Law Society of Ontario, is listed in peer-reviewed publications – Lexpert® and The Best Lawyers™ in Canada, is ranked AV Preeminent® in Martindale-Hubbell ® and is a partner at Thomson Rogers, one of Ontario’s Top 10 Personal Injury Law Firms as selected by Canadian Lawyer Magazine, and ranked one of the Best Law Firms in Canada by The Globe and Mail.

Darcy can be reached at 416-868-3176 or by EMAIL.

Share this