Seven Tips For Preparing Treatment And Assessment Plans

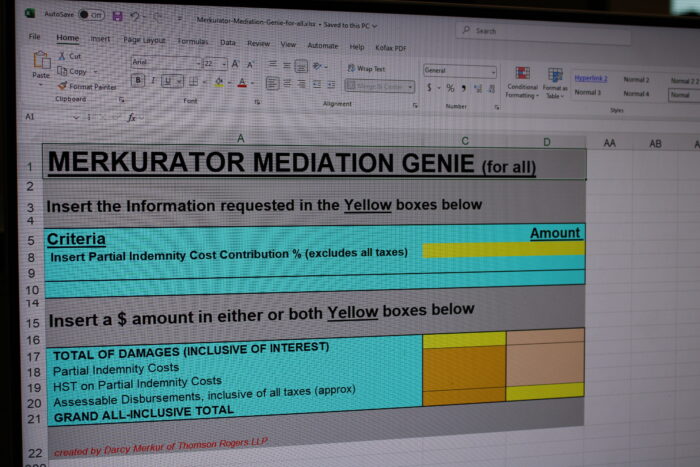

Author(s): Darcy R. Merkur

February 8, 2021

The no-fault Ontario accident benefit system is complex. To access treatment, accident victims must have healthcare providers submit treatment and assessment plans (OCF-18s) to insurance companies for pre-approval in most circumstances.

Because pre-approval from the insurer is required, it is imperative that these treatment and assessment plans are approved.

Here are seven tips for preparing treatment and assessment plans to help healthcare providers get their treatment and assessment plans approved.

Start Small With Initial Treatment And Assessment Plans

Accident benefit adjusters typically object to overreaching initial treatment and assessment plans that set out a lengthy course of treatment before the person has been properly assessed and before the person has actively begun treatment. Insurers are often uncomfortable at the outset to approve long lasting and expensive treatment and assessment plans especially since they often have to respond to the plans before they have access to the initial hospital records and the various relevant medical records they require. Given these initial understandable documentary deficiencies resulting from logistical delays obtaining records, it is recommended that initial treatment and assessment plans cover a smaller window of treatment with an express notation of anticipated subsequent plans being submitted. This ‘start small’ approach helps avoid forcing the insurer to commit to an expensive long-term plan without them having the records they need to better understand the gravity of the situation.

Explain the Purpose, the Support and the Consequences Without

Wherever possible, the treatment and assessment plan should include comments explaining briefly why the treatment is required and who it was recommended by (if recommended by a physician, etc.). Moreover, wherever possible, the treatment and assessment plan should explain what might happen if the person does not access the treatment (such as a deterioration in the client’s mobility, or exposing the client to safety hazards, etc.).

Dialogue with the Insurance Adjuster

Whenever an elaborate treatment and assessment plan is being contemplated, it is wise to contact the accident benefit adjuster and dialogue with them about the plan before submitting it. By speaking with the adjuster, you will develop a rapport and will get a better read on the likelihood that the plan will be approved as proposed. Regularly the accident benefit adjuster will tip their hand on their perspective. If they seem fine with the plan, then you can expect it to be approved. On the other hand, if they express reservations then you need to understand their reservations and consider modifications to the treatment and assessment plan to address their concerns. By speaking with the adjuster before submitting a plan you will reduce the probability of a denial.

Team Approach

In catastrophic impairment claims, team meetings are regularly held where the entire rehabilitation team discusses the claim and the client’s treatment needs. Wherever possible (and there are some exceptions to this rule) the accident benefit adjuster should be welcome to participate in those team meetings. Insurance adjusters were typically unable to attend in-person for team meetings, but now that team meetings are being held virtually, it is easy to include the accident benefit adjuster and they often will participate. I find that insurance adjusters are much more cooperative when they actively participate in a client’s rehabilitation though participation in team meetings. It is not easy for an accident benefit adjuster to look the injured person and their family in the face as well as the entire rehabilitation team and deny treatment that is globally recommended by all. At the team meetings, with the adjuster present, any controversial treatment and assessment plans can be discussed and with input from the entire team, the accident benefit adjuster will be better able understand the reasoning for the treatment and approve it. The Minutes from the team meeting should reflect any consensus treatment recommendations so that the accident benefit adjuster has an understanding of the difficulty they will have denying the plan especially if it was pushed to a hearing.

Avoid Insurer Examinations (IEs)

Clients hate IEs. Lawyers hate seeing IE reports. They are too often slanted in favour of the insurer and they often don’t seem to put the injured person’s interests at the forefront. Avoid IEs wherever possible by negotiating plans and following the advice above. Because the modest non-catastrophic limits are often going to be exhausted regardless of the approval of one desired treatment plan, withdrawing of a controversial plan is sometimes a decent solution to avoid IEs. Other funding solutions can be considered to access desired treatment without forcing the insurer to do an IE, which may negatively impact the claim or lawsuit while unnerving the client and delaying treatment.

A LAT Dispute is Not a Good Solution

The LAT system was designed to be expeditious. It is not. It takes forever. The lineup is enormous. It is not a practical solution for a denied treatment and assessment plan unfortunately. Frankly, it is a disaster and, practically speaking, it should be reserved for crucial disputes such as a catastrophic impairment designation and/or entitlement to ongoing income replacement benefits. The threat of filing a CAT dispute in relation to a denied treatment and assessment plan is not concerning to the accident benefit adjuster because they are well aware that the LAT lineup is enormous and the consequences if the insurer loses the debate are modest. The LAT provides no cost consequences and even a special award is quite limited in the context of a modest treatment and assessment plan denial.

Get the Personal Injury Lawyer’s Help

If you followed all the instructions above and the adjuster will not budge then ask the personal injury lawyer to step in to help. Often the adjuster is handcuffed by instructions from their supervisor or by their internal bureaucracy. The trauma lawyer can sometimes help cut through that red tape by following up with their manager or supervisor and facing into the internal problems they have. The lawyer should be the last line of defence to help navigate the issues above. Where necessary, the trauma lawyer can raise complaints about unfair conduct by insurance adjusters including demanding having difficult adjusters replaced.

At Thomson Rogers we have spent decades assisting thousands of injured Ontario motorists through the complex accident benefit process.

By following the seven tips for preparing treatment and assessment plans above you will put us in a much better position to help you access the treatment you need following a serious motor vehicle accident.

At Thomson Rogers we offer free consultations so please feel free to reach out to us at any time. We are here to help.

Darcy Merkur is a highly regarded Ontario trauma lawyer helping accident victims such as pedestrians, cyclists and motorists, who have sustained catastrophic injuries.

Darcy is the first lawyer in Canada to be qualified as a Certified Brain Injury Specialist by the Brain Injury Association of America. In addition, Darcy has been recognized as a Certified Specialist in Civil Litigation by the Law Society of Ontario, is listed in peer-reviewed publications – Lexpert® and The Best Lawyers™ in Canada, is ranked AV pre-eminent in Martindale-Hubbell ® and is a partner at Thomson Rogers, one of Canada’s Top 10 Personal Injury Law Firms as selected by Canadian Lawyer Magazine.

Darcy can be reached at 416-868-3176 or by EMAIL.

Share this