Ontario Auto Insurance Premiums Remain High Despite Fewer Drivers on the Road? Here’s why.

June 11, 2021

56% Fewer Accidents But Auto Insurance Rates Remain High

At the start of the pandemic one respite that millions of Ontarians needed severely was a reduction in their auto insurance premiums. With fewer people commuting to work than ever, and most not doing any driving at all, the stage was set for an unprecedented decline in auto insurance rates.

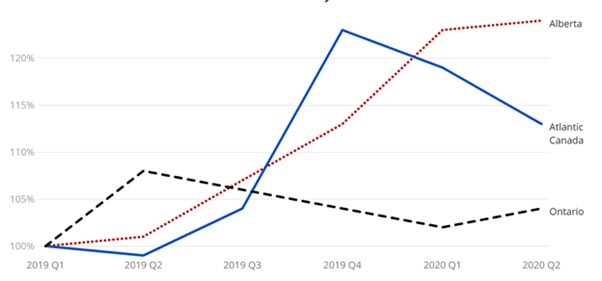

But, what we got instead was this.

Source: CBC

Yes, auto insurance rates did go down, but only ever so slightly in the first three months of 2020. Between April and June 2020 – the peak of Ontario’s first lockdown – they were showing an upward trend again.

Why Have Car Insurance Premiums Rankled So Many

From March to July 2020, Ontario saw a 56.67% decline in accident rates, compared to the same period in the previous two years. Fewer accidents mean fewer claims. With this lesser risk of accidents, insurance premiums should have come down.

In fact, insurance rates rebounded almost immediately in 2020 (see figure), just as millions of Ontarians became dependent on CERB after having lost their livelihoods. Not long after that insurance rates had increased by 1.8%, up even from pre-pandemic levels.

Car insurance rebates for COVID-19 from insurers, too, were publicized extensively at the start of the pandemic, though few people actually received a meaningful amount. Many of the car insurance ‘refunds’ for COVID-19 came from people simply negotiating down their insurance policy because they were no longer commuting to work.

This follows a widely unpopular move in 2016 to reduce the statutory accident benefits available to those injured in car accidents across the board. Particularly egregious has been the $1 million cap for those who have suffered catastrophic injuries, leaving some of the most vulnerable even more exposed. Any trauma lawyer will tell you that medical expenses for serious injuries can deplete that very quickly.

| Learn more: |

What Does the Insurance Industry Have to Say

For the most part, insurance companies have stayed mum on the subject, letting the IBC do the talking for them.

The IBC’s standard response has been that due to the pandemic more people have switched from public transit to driving. And one year on from the first lockdown, people are preferring to drive instead of taking public transit. It makes no mention about fewer accidents due to the lockdowns.

In other words, business as usual and you should expect Ontario’s car insurance to increase in 2021.

How Can You Lower Your Car Insurance in Ontario?

As a motorist you should do what you can to lower your car insurance – drive safe always, but also shop around for competitive premiums. If you are driving fewer kilometres because of ‘work from home’ and aren’t using your vehicle to commute, you should advise your insurer.

Reducing your annual mileage and intended use of the vehicle may lower your car insurance premium. Even then, young and new drivers may receive no savings at all.

Get in Touch With Our Car Accident Lawyers

Since 1935, Thomson Rogers has been at the forefront of personal injury law, helping you get the compensation and treatment you deserve.

If you or someone you know has been involved in a car accident, get in touch with our auto accident lawyers in Toronto immediately. We’ll tell you your options, how you can maximize your accident benefits, and how you should proceed with your claim.

In light of COVID-19, we are available for virtual appointments. Consultations are completely confidential and free of charge.

For Thomson Rogers updates please subscribe to our email list here.

Share this